How do banks work? –

What we're covering..

Introduction 👋

We all know banks – but how do they work? and how do they make money?

Today we’re explaining the ins and outs of banks!

Banks are businesses 🏦

Banks are businesses.

They help people to manage their money, by doing things like:

- Looking after money in bank accounts – things like current accounts and savings accounts

- Lending people money – loans like mortgages

- Helping people pay for things – payment cards like debit cards, credit cards

Disclaimer: This website provides information for guidance and educational purposes only. The Grown-Up School does not provide regulated financial advice. You can seek independent financial advice from a suitably qualified and regulated professional advisor. Check out our disclaimer policy for more information.

How do banks make money? 💸

Charging “Interest” 💸

Banks are businesses, so they don’t do everything for free!

One of the main ways that banks make money, is by lending you money.

When you borrow money, banks will make you pay something called “interest“.

Interest is like paying “extra” money, to say thank you for borrowing money.

For example:

You need to borrow £10, and the bank asks you to pay £2 extra in “interest” to say thank you for lending the money. You would have to pay them back £12 in total.

Lending money to buy homes (mortgages) 🏡

To make a lot of money as a bank, you have to lend a lot of money.

And what are the most expensive things you can lend money for? Houses!

Lending money to buy a house is called a mortgage, and they are one of the biggest ways that banks make money.

If you borrow money to buy a house from a bank, you will usually have to pay interest.

For example:

If you needed to borrow £200,000 to buy your house, and the bank asks you to pay £60,000 extra in “interest” to say thank you for lending the money. You would have to pay them back £260,000 in total.

But how do banks get so much money to help people buy houses? 💰

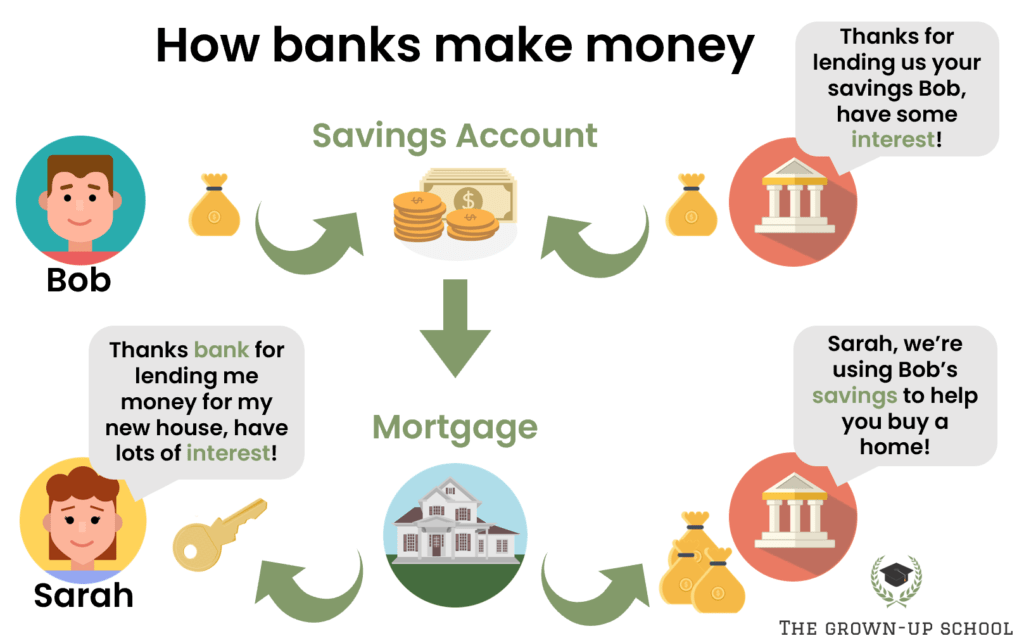

Banks collect money to lend in lots of different ways, but one of the main ways is through savings accounts.

When you set up a savings account, banks will usually pay you interest, to say thank you for lending them the money!

For example, if you put £10,000 into a savings account, a bank might pay you £200 in interest every year to say thank you for keeping your money there. They will usually then lend your money out to people through mortgages, so that they can make lots of money!

Of course if you ask the bank for your savings back, they will have enough money to give it back to you. The government for the country will usually set rules for banks to make sure that customers can get their money back then they need it.

Conclusion 👍

So that’s it!

Hopefully that all makes sense, and that you understand a bit more about how banks work! If you know any friends or family members who might benefit from these articles, feel free to share it with them!

Finally, don’t forget to check out our similar articles below!

Similar articles to “How do banks work?” ⬇️

4 money myths you shouldn’t believe 🦄

Why you should save for retirement when you’re really young 🧓

8 reasons to start saving money now 🐷

Is borrowing money a bad thing? 🤷♀️

8 bad money habits you should break💰

🎓

Follow us!

for free daily Grown-Up lessons 🙌🎉