How do payslips work? –

What we're covering..

Introduction 👋

Getting a job is really exciting.

I mean, who doesn’t love getting paid? 💸

BUT getting paid can be a bit confusing – when payday comes around, you get sent a payslip. 📨

Payslips are really important, but nobody explains what they’re for! 🤷♀️

All the information on a payslip can be really confusing – especially if nobody has shown them to you before. 🥴

See below for our ultimate guide to understanding payslips! 📃

Disclaimer: This website provides information for guidance and educational purposes only. The Grown-Up School does not provide regulated financial advice. You can seek independent financial advice from a suitably qualified and regulated professional advisor. Check out our disclaimer policy for more information.

What are payslips? 🤷♀️

Payslips are documents that tell you how much you’re getting paid.

If you have a job with an employer, every time they pay you, you’ll be given a payslip.

Payslips are usually sent on a piece of paper or a digital document. 📃

Your payslip can tell you how much money you’re:

- Getting paid from your employer 💰

- Paying to the government in tax (What is tax? 💸) 🏛️

- Putting towards your pension (money to look after you when you’re older) 🧓

- Paying off your student loan (if you’ve borrowed money for education)🎓

- Being given as sick pay (if you’ve been sick) 🤒

- Being given as maternity/paternity/adoption pay (if you’ve become a parent) 🍼

- Paying towards court payments/child maintenance (if you’ve received court fines or you have to pay towards your children) 👩⚖️

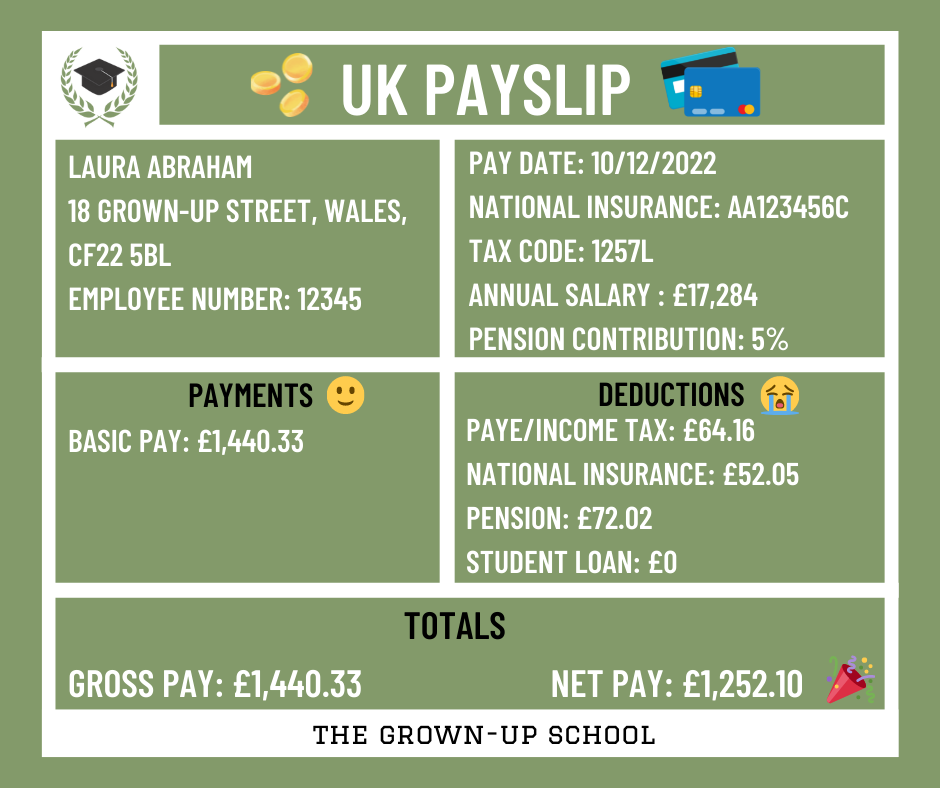

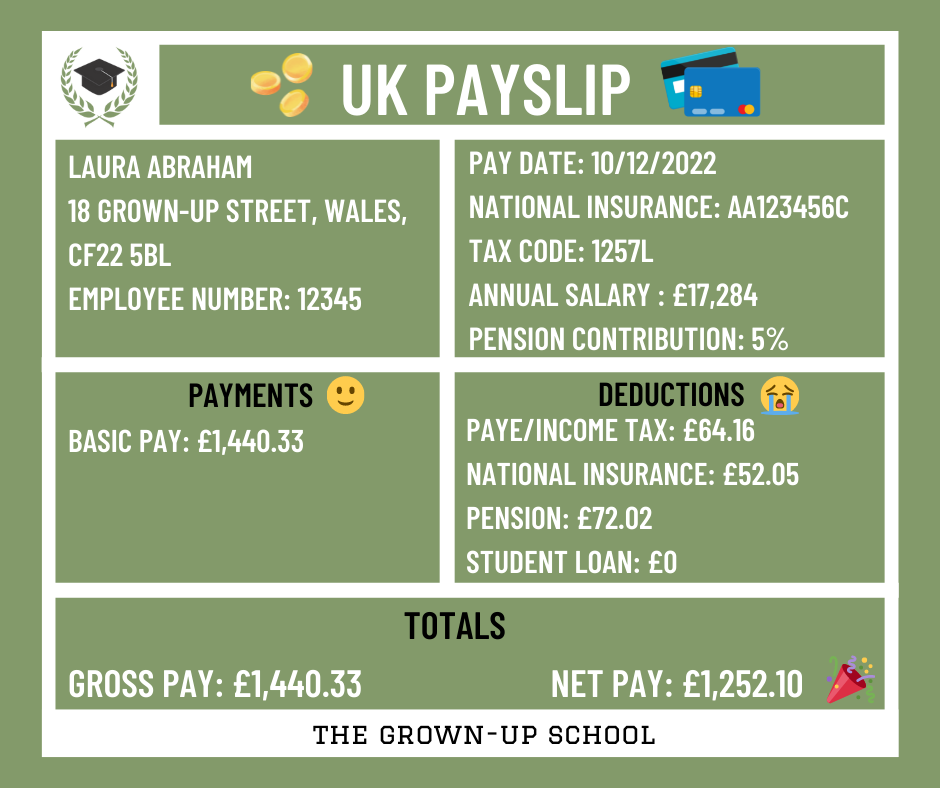

They can look a bit like this! ⬇️

What information is included on a payslip? (UK) ✨

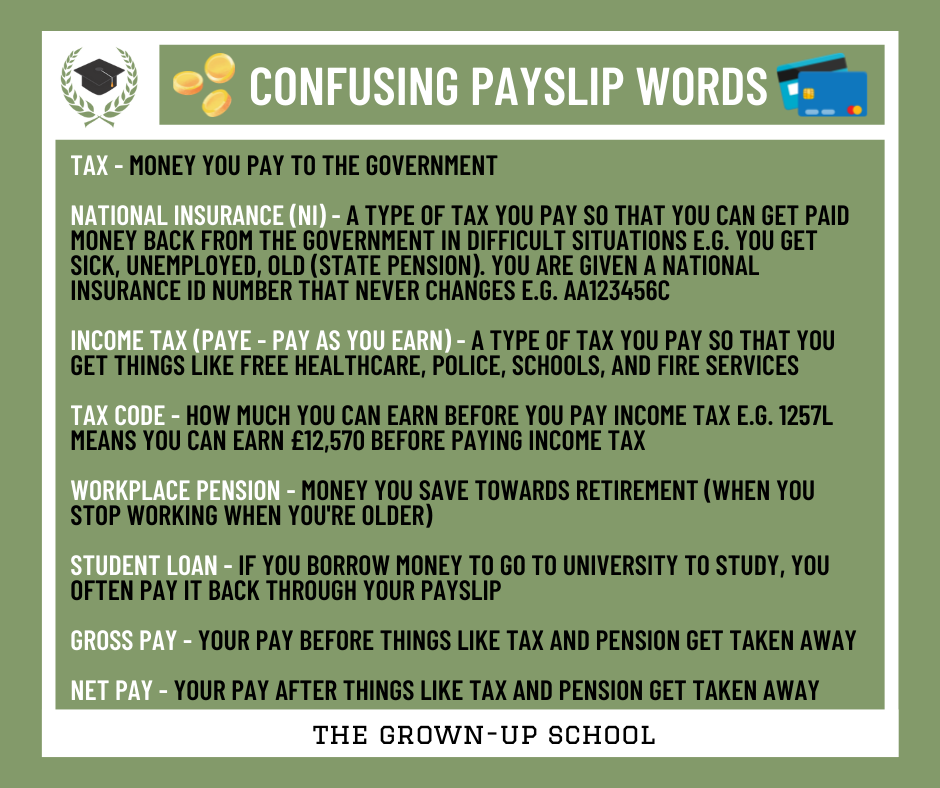

Tax 🏛️

Tax is money that people and businesses have to pay to the government.

People pay money to the government in order to get services like police stations, fire and rescue services, and schools.

Tax is mandatory so people living in a country have to pay it – otherwise they could get into a lot of trouble! 👩⚖️

National insurance (NI) ⛑️

National insurance is a type of tax you pay so that you can get paid money back from the government in difficult situations.

For example, national insurance helps to pay for things like:

- Sick pay 🤒

- Unemployment pay – if you’ve lost your job or aren’t working 💼

- State pension – when you get old and can’t work any more 🧓

- Maternity pay – if you’ve become a parent 👶

Every person also gets a national insurance number to help them to pay their tax. 💳

State pension 🧓

In the UK you can get “state pension” from the government. 💸

This is money that you can claim from the government at “pension age” (66-68 years old depending on when you were born). 🧓

You get this money after paying “national insurance tax” to the government when you work. 💼

You need to pay towards “national insurance” for 35 years to get the full state pension money from the government. 🗝️

In 2021/22 people can get up to £179.60 per week as their state pension.

For a lot of people this isn’t enough money to comfortably live off when they retire, which is why they invest in pension schemes/workplace pensions.

Why you should save for retirement when you’re really young 🧓

National insurance number (NI number) 💳

Just before you turn 16, people in the UK are sent a national insurance ID number in the post. 📬

Your national insurance number never changes. 🗂️

They’re made up of a weird combination of letters and numbers e.g. AA123456C.

It’s important to keep your national insurance number safe and handy, because every job that you get will want to know what your national insurance number is. 🧐

Income Tax (PAYE – Pay As You Earn) 😴

Are you a lazy person? 🦥

Great!

You’ll love PAYE (pay as you earn)! – It basically means that your employer:

- does all the maths for you

- calculates your income tax for you

- sends your income tax payments to the government for you

Income tax is money that people have to pay to the government.

When you make money, you have to pay part of the money you make to the government. There are lots of different rules about how much money you need to pay.

If you don’t pay your tax on time, you could get fined and have to pay more money. The government will usually help you to pay your tax.

People have to pay income tax on money they make from things like:

- Their jobs

- Renting out their house

- Selling things online

- Having a savings account

- Owning their own business

In the UK, income tax helps to pay for things like:

- Free healthcare 🧑⚕️

- Police 👮

- Schools 🧑🏫

- Fire services 👩🚒

- Roads 🛣️

- Railways 🚄

- Housing 🏘️

Tax code 🤓

Your tax code decides how much income tax you pay.

For example, in the UK if your tax code is 1257L – this means that you can earn £12,570 before you have to start paying income tax.

Anything you earn over the £12,570 will be charged tax.

Workplace Pension 🧓

Workplace pensions are money that you save towards retirement (when you stop working when you’re older).

Pension schemes are a type of long-term savings plan. 🐷

You save some of your pay regularly whilst you’re working. 🌱

This gives you money to live off in later life, when you want to work less or retire. 🌳

There are different types of pension schemes —

Some might be set up by your employer, others you can set up by yourself. 🙋♀️

If your employer sets up a pension for you this is called a workplace pension. 💼

A lot of workplaces offer free pension contributions, depending how much you put in. 💸

For example, if you pay 8% of your salary into your pension savings, your employer might double that, meaning every year an amount equal to 16% of your salary is going towards retirement. 💸💸💸

How cool is that? 😲

That could be a crazy amount of free money from your employer, which might grow over time with your pension investments 🤑🪴

Why you should save for retirement when you’re really young 🧓

Student Loans 🎓

If you borrow money to go to university to study, you often pay it back through your payslips. 📃

You usually can’t choose how much you pay back, which is different to normal loans like credit cards, where you can choose how much you pay back every month. 📆

Gross pay 💰

Gross pay is a bit annoying – it’ll probably make you a bit sad when you first see it!

This is because your gross pay is how much you would get paid IF you didn’t have to pay tax, pension and a ton of other deductions! 😢

Your gross pay, is your pay before things like tax and pension get taken away. 💸

Net pay 🥅

This is the best part of your payslip! 🎉

Your net pay is how much you’re getting paid.

It tells you how much money should be sent to your bank account! 💸

Your net pay is how much you’re getting paid, after things like your tax and pension get taken away. 💳

What can I use my payslips for? 🤷♀️

You can use your payslips for things like:

- Checking how much you’re getting paid 👀

- Making sure that your employer has paid you the right amount, and paid the right amount of tax to the government for you💸

- Proving your address 🏡

- Proving you have a job (e.g. if you’re renting a home What is renting? 🏠) 💼

- Applying for loans (to prove how much money you’re earning – particularly for buying a home with a mortgage loan What is a mortgage? 🏡) 💳

- Proving to the government how much money you’re earning, and how much tax you’ve paid them 🏛️

- Proving to your pension provider how much you’ve paid towards your pension 🧓

What you should do with your payslips 🕵️

1. Check all the information is right 🔍

It’s really important to make sure that everything on your payslip is right, because you need your payslips to prove things!

You should check everything on your payslip, including things like:

- Your name

- Address

- National insurance number

- Pension payments

- Student loan payments

- National insurance payments

- Income tax (PAYE – Pay As You Earn) payments

Most importantly, check your tax code!!

Check your tax code!! 👀

Your tax code decides how much income tax you pay.

If your tax code is wrong, you could:

- Pay too much income tax and be entitled to a “tax rebate”!

- Pay too little income tax, and get a massive unexpected tax bill sent to you from the government!

What to do if your tax code is wrong (or you’re not sure if it’s right) 🥴

If you’re not sure what your tax code is supposed to be (or you think it’s wrong), you can:

- Check the UK income tax rules here – https://www.gov.uk/income-tax 📝

- Speak to HMRC (Her Majesty’s Revenue and Customs — the people who collect the tax!) 🤓 https://www.gov.uk/government/organisations/hm-revenue-customs/contact/income-tax-enquiries-for-individuals-pensioners-and-employees

2. Keep copies 🖨️

Mistakes happen, and sometimes employers lose their copies of payslips.

It’s always good to keep copies of your payslips, just in case! 🤞

3. Keep your payslips safe 🔐

Payslips contain A LOT of your precious personal information, which could easily be used to steal your identity or scam you. 🦹

Keep your payslips in a safe, secret place so that nobody else can access them!

35 ways to protect yourself from scammers 🦹

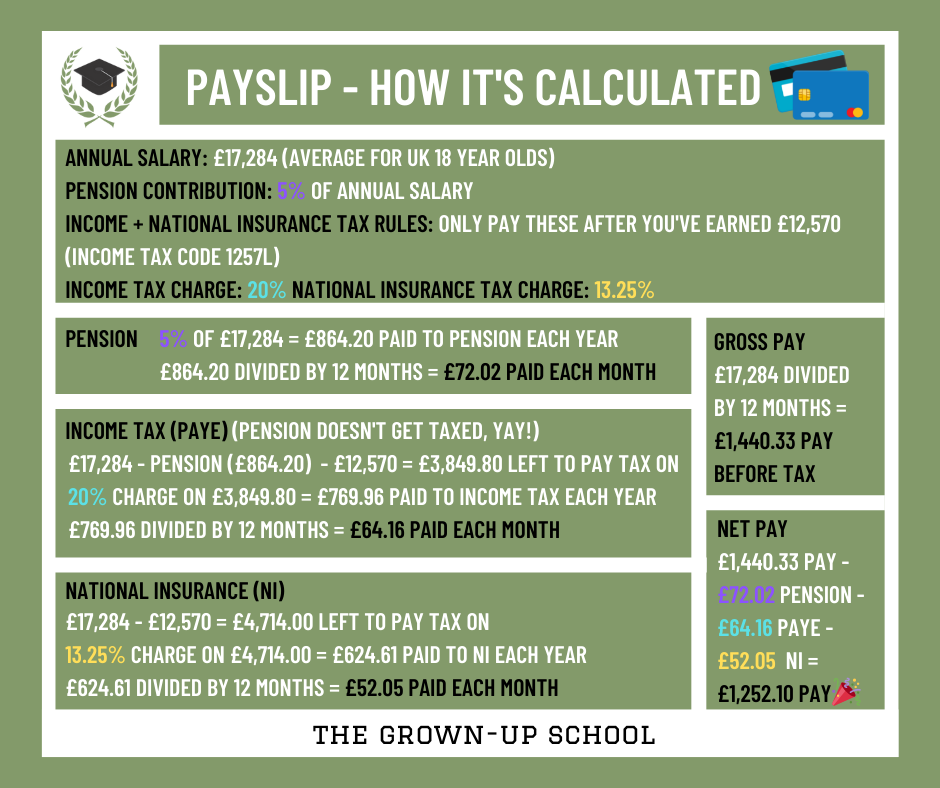

How payslips are calculated 🤓

To calculate your payslip, your employer will follow 3 main steps:

1. Work out your gross annual/monthly pay 💰

To work out your gross monthly pay, you:

- Take your agreed yearly pay and divide it by 12 (because there are 12 months in the year!)

For example, if your “gross pay” each year was” £17,284:

£17,284 / 12 = £1,440.33

Your gross monthly pay would be £1,440.33!

(If you’ve worked extra hours etc. this would need to be added in too!) ⌚

2. Work out how much needs to be deducted from your gross pay 📉

Next, you work out how much tax and other stuff you need to pay. 😢

Pension 🧓

You can usually choose what percentage you want to pay towards your pension. ⚖️

A lot of people are encouraged to pay at least 5%.

To work out your monthly pension payments, you:

- Take your agreed “gross” yearly pay (£17,284)

- Work out your pension percentage from your yearly pay (5%) (£17,284 * 0.05 = £864.20)

- and divide it by 12 (because there are 12 months in the year!) (£864.20 / 12 = £72.02)

Your monthly pension payments would be £72.02!

Income Tax (PAYE – Pay As You Earn) 💰

The UK government has different rules to decide how much income tax you need to pay.

You can check these on the government website here.

If you are earning £17,284 each year the rules could be as follows:

- Your tax code is 1257L – which means you can earn £12,570 before you pay income tax. £12,570 is your “tax free allowance”.

- Anything over £12,570, you have to pay an income tax charge of 20% on.

To work out your monthly income tax payments, you:

- Get your agreed “gross” yearly pay (£17,284)

- Take away your yearly pension payments which we just calculated above ⬆️ (because you don’t have to pay tax on these – yay!) (£17,284 – £864.20 = £16,420.80)

- Take away your “tax free allowance” (£16,420.80 – £12,570 = £3,849.80)

- This will tell you how much you have earned over the “tax free allowance” (£3,849.80)

- Charge your “money left to tax” the income tax rate e.g. 20% (£3,849.80 * 0.20 = £769.96)

- You’re now left with how much tax you have to pay each year (£769.96)

- To work out your monthly payments divide your yearly payments by 12 (because there are 12 months in the year!) (£769.96 / 12 = £64.16)

Your monthly income tax payments would be £64.16!

National Insurance (NI) ⛑️

The UK government has different rules to decide how much national insurance you need to pay.

You can check these on the government website here.

If you are earning £17,284 each year the rules could be as follows:

- You can earn £12,570 before you pay national insurance.

- Your “tax free” amount is £12,570.

- Anything over £12,570, you have to pay a national insurance charge of 13.25% on.

To work out your monthly national insurance payments, you:

- Get your agreed “gross” yearly pay (£17,284)

- Take away the “tax free” amount (£17,284- £12,570 = £4,714.00)

- This will tell you how much you have earned over the “tax free” amount (£4,714.00)

- Charge your “money left to tax” the national insurance tax rate e.g. 13.25% (£4,714.00 * 0.1325 = £624.61)

- You’re now left with how much tax you have to pay each year (£624.61)

- To work out your monthly payments divide your yearly payments by 12 (because there are 12 months in the year!) (£624.61 / 12 = £52.05)

Your monthly national insurance payments would be £52.05!

3. Calculate net pay 🥅

Now that you know how much you:

- Earn in “gross pay” before deductions

- How much you need to pay in deductions (tax, pension, student loan payments)

It’s time to work out how much money you’re going to be left with! (Your net pay!)

To your monthly net pay (how much you’re taking home – yay!), you:

- Take your gross monthly pay (£1,440.33)

- Take away your monthly deductions e.g. pensions, income tax, and national insurance ( £1,440.33 – £72.02 (pension) – £64.16 (income tax) – £52.05 (national insurance) = £1,252.10)

Your monthly net pay would be £1,252.10!

This means that your employer would send £1,252.10 to your bank account on payday. 🎉

What if I’m self-employed? 👷♀️

If you work for yourself, or own your own business, you’re considered “self-employed”.

Self-employed people:

- Get paid by their customers 💸

- Don’t get payslips

- Have to be SUPER organised and pay their income tax and national insurance tax themselves 🗃️

- Have to complete a form/questionnaire called a “tax return” every year, to pay their taxes 📃

- Need to be very careful with their money, and set money aside to pay their tax bills

- Can hire an accountant to help handle their taxes if they want to make life easier 🦥 What is an accountant? 👩💼

Conclusion 👍

So that’s it!

Payslips are documents that tell you how much you’re getting paid.

You can use payslips for lots of things, like proving how much money you earn and where you live.

You should:

- Keep your payslips safe 🔐

- Make sure that your payslips are accurate 🔍

- Keep copies of your payslips 🖨️

If you know any friends or family members who might benefit from learning about payslips share this post with them!

Finally, don’t forget to check out our similar articles below!

Similar articles to “How do payslips work?” ⬇️

Interview tips – why did you leave your last job? 🏃♀️

How to find your dream job 🦸♀️

15 quick and easy ways to make extra money 🫰

14 money-related red flags to look for in relationships 🚩

Interview questions to ask your interviewer – top 10 🎤

How to write an amazing CV/resume (with template!) 📜

What to wear for an interview 👕

How to answer difficult interview questions 😨

🎓

Follow us!

for free daily Grown-Up lessons 🙌🎉